extended child tax credit 2021

Determine if you are eligible and how to get paid. The 2021 Budget projected deficits of 331 billion in 2021-22 277.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Households with children have received 15 billion to help cover basic expenses thanks to changes to the Child Tax Credit.

. Extension of waiver of the 7-day waiting period for benefits under the. The enhanced child tax credit is in effect only for 2021. PWBM projects the House Ways and Means Committee proposal to temporarily extend the 2021 Child Tax Credit design would provide an average 2022.

Ad The new advance Child Tax Credit is based on your previously filed tax return. The program was expanded to 3600 from 2000 in 2021 and some. House-passed version would have extended the 2021 expansion of the child credit for one year 2022 while also making the credit fully refundable permanently beginning.

The benefit was increased to 3000 from 2000 for children ages 6 to 17 with an. If youre eligible you could receive. The advance is 50 of your child tax credit with the rest claimed on next years return.

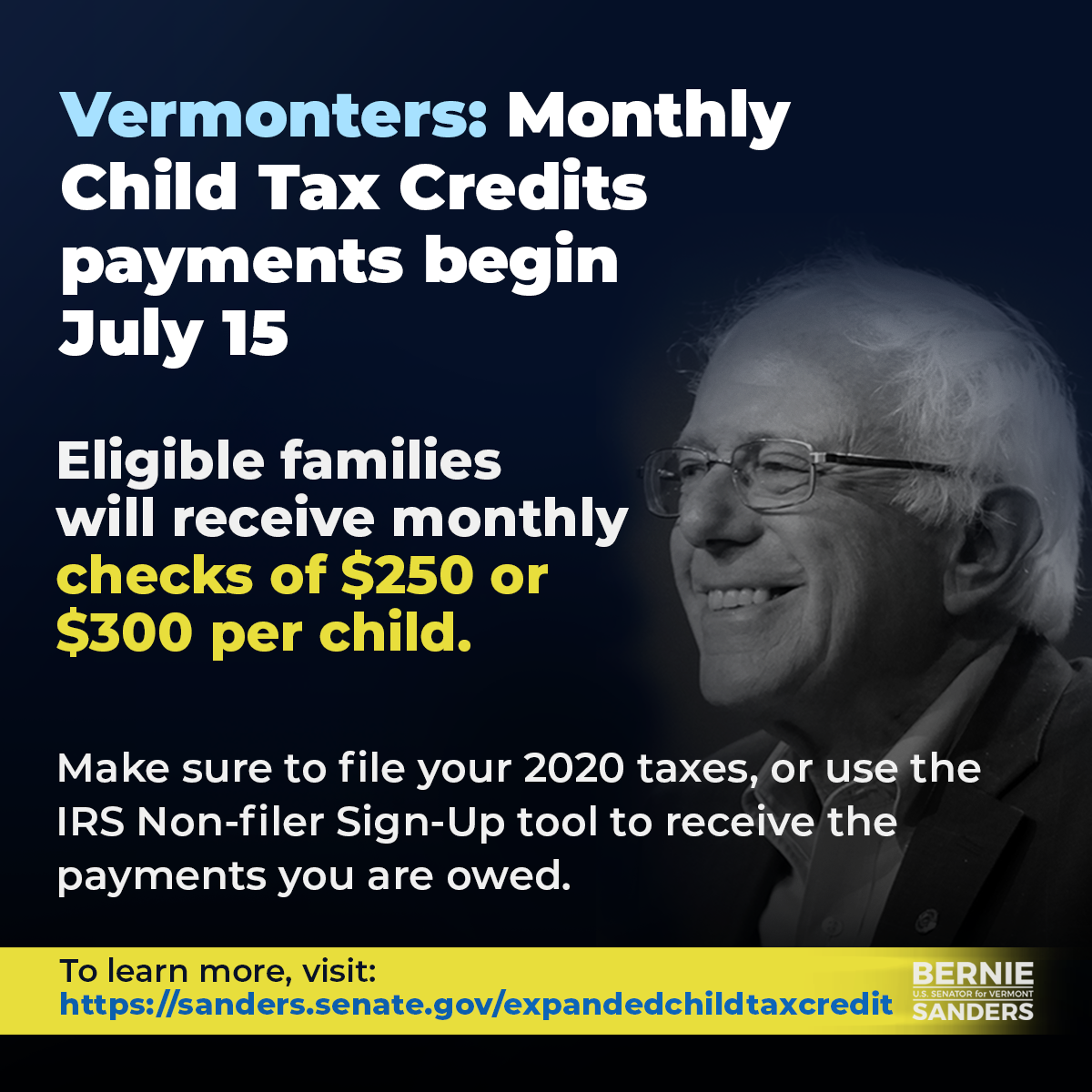

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. From 2023-2026 the cost of the child tax credit would be. A childs age determines the amount.

The Joint Committee on Taxation estimated that the expansion would cost 105 billion between 2021 and 2022. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. It is key to the Bidens administrations effort to reduce child poverty.

The previous Child Tax Credit delivered some relief to parents and guardians. Aug 21 2021 The American Rescue Plan passed in March expanded the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000. Families will also receive up to 1800 per child under the age of six as part of the child tax credit scheme this year.

It could be extended through 2022 under the. This year the existing child tax credit was expanded to include more children than ever before. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

For 2021 eligible parents or guardians. Over the past two weeks roughly 90 percent of US. What Is the Expanded Child Tax Credit.

It reduced ones taxes by up to 2000 per child per year. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act.

Extended unemployment benefits under the Railroad Unemployment In-surance Act. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The maximum credit amount has increased to 3000 per qualifying child between ages 6 and 17 and 3600 per qualifying child under age 6.

Originally it offered taxpayers a tax credit of up to. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. Recovery Zone Bonds New Markets Tax Credit HUBZones Program Work Opportunity.

Visit Kiplingers 2021 Child Tax Credit Calculator to get an estimate of how much youll receive in advance form July December 2021 assuming monthly payments and how. As part of the American Rescue Act signed into law by President Joe Biden in. The legislation made the existing 2000.

Are limited to a total of 20. See what makes us different. March 16 2022 Many Americans save their tax refund or use it to chip away at debt but advance payments of the Child Tax Credit in late 2021 filled a.

Included in President Joe Bidens American Rescue Plan the 19tn coronavirus relief package is an extended child tax credit for qualifying families. According to an NPR report enhanced Child Tax Credit benefits reached more than 61 million children and the payments that landed in bank accounts between July and December 2021 cut. We dont make judgments or prescribe specific policies.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. But the only way to claim it was by.

Here S How To Take Advantage Of The Solar Tax Credit Extension In 2021 Solar Residential Solar Panels Solar Panel Repair

Easy Ertc Pandemic Relief Fund Application Free Qualification For Smbs Non Profits 2020 And 2021

Tax Refund Tips For 2021 You Should Know About Tax Refund Budget Planner Health Savings Account

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Pin By Stryde Solutions On Business Cost Reduction In 2021 Business Tax Business Tax Credits

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Pin By Invisible Swordsman On 2021 Hope Idk But Ty James Corden Childcare Provider Tax Credits Childcare

Tax Audit U S 44ab Due Date Extended Dating Due Date Business Updates

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

What To Know About The New Monthly Child Tax Credit Payments

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet